March Home Prices Continue to Rise

- May

- 26

- Posted by Lake Norman Homes Realty

- Posted in Home Buyers Blog

- 0

According to FNC’s Residential Price Index™ (RPI), U.S. home prices continued to rise at a brisk pace in March and up 0.9 percent nationwide.

March’s increase follows a strong momentum in February that recorded some of the largest unseasonable gains in many of the nation’s key housing markets. With continued low interest rates and easing credits, particularly recently launched low-down-payment conventional loans by Fannie Mae and Freddie, home prices are positioned for strong gains. This spring/summer home buying season already appears well under way across the West, South, and Midwest regions.

The latest development in the for-sale market shows the pace of home sales has picked up rapidly since March. The median time-on-market is down from 128 days in March to 106 days in April, the fastest seasonal pace for the month of April since the housing market began to recover in early 2012. The average asking-price discount is 3.3 percent, down from 4.2 percent in March.

Completed foreclosures in March comprise about 13.7 percent of total existing home sales, down by two percentage points from February’s 15.8 percent.

FNC’s RPI is the mortgage industry’s first hedonic price index built on a comprehensive database that blends public records of residential sales prices with real-time appraisals of property and neighborhood attributes. As a gauge of underlying home values, the RPI excludes final sales of REO and foreclosed homes, which are frequently sold with large price discounts, likely reflecting poor property conditions.

The attached table shows seasonally unadjusted month-over-month (MOM) and year-over-year (YOY) changes in three composite indices. The national index is based on recorded sales of non-distressed properties (existing and new homes) in the 100 largest metropolitan areas. Both the national and 30-MSA composite indices were up at a seasonally unadjusted rate of 0.9 percent. After a relatively steep gain in February, the 10-MSA composite moderated slightly during the month and was up 0.6 percent. Quarterly performance across the indices was dragged lower by a weak January, registering a small gain of about a half percentage point. Average home price appreciation ticked up slightly but remained in the 4.5-5.0 percent range nationwide.

The attached chart tabulates the latest MOM and YOY price trends for each MSA in the FNC 30-MSA composite index. Home prices are up in all MSAs except San Antonio, Baltimore, and New York. Of the 27 up-markets, 21 cities recorded more than a 1 percent MOM increase in March, led by Tampa, Nashville and Chicago at 3.4 percent, 3.2 percent, and 2.8 percent, respectively. For Chicago, Portland, Riverside, CA and Sacramento, March marks a second consecutive month of strong price momentum. Other cities that appear off to a strong start of the spring home buying season include Atlanta, Cincinnati, Dallas and Minneapolis.

While most of the nation’s housing markets have gained momentum, New York, San Antonio and Baltimore continue to show weakening prices as of March, down 1.6 percent, 0.3 percent, and 0.5 percent, respectively. Baltimore’s foreclosure sales have climbed rapidly in recent months, largely contributing to its continued price weakness. Foreclosure sales in New York also appear to be at three-year highs.

As of March, the fastest YOY growth markets are Las Vegas (13.1 percent), Riverside (12.0 percent), and Dallas (10.1 percent), which are followed by a number of other cities that also continue to enjoy robust appreciation: Los Angeles (9.6 percent), San Diego (9.4 percent), Orlando (9.4 percent), Miami (9.3 percent), Portland (9.2 percent), and Atlanta (8.7 percent).

Source: FNCInc.com

Mike Spruell

Realtor®/Broker/ePRO

The Lake Norman Homes Team

Southern Homes of The Carolinas

www.LakeNormanRealEstate.pro

866-LakeNorman

704-907-7907

Reprinted with permission from RISMedia. ©2015. All rights reserved.

read moreAmericans Agree: Real Estate Best Long-Term Investment

- Apr

- 28

- Posted by Lake Norman Homes Realty

- Posted in Home Buyers Blog

- 0

By Suzanne De Vita

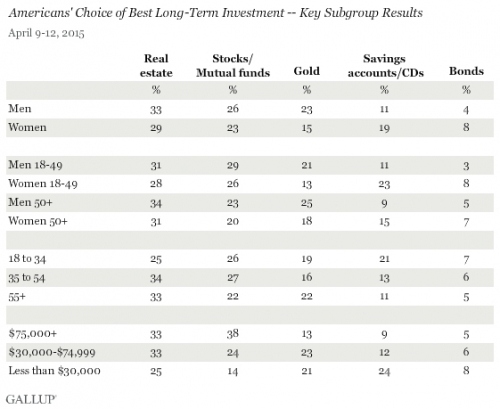

Signaling growing confidence in the housing recovery, a majority of Americans once again named real estate the best long-term investment – a trend now continued for two consecutive years, according to a recently released Gallup poll.

Real estate edged out long-term investment options like stocks/mutual funds, gold, savings accounts/CDs and bonds, with 31 percent of Americans favoring housing for long-term gains. Twenty-five percent of Americans named stocks/mutual funds as the best investment long-term. Gold dropped from frontrunner in 2011 and 2012 to third, while savings accounts/CDs fell to 15 percent. Bonds dipped to just six percent.

The findings represent a significant change in consumer sentiment akin to the ongoing recovery. Notably, more Americans preferred savings accounts/CDs in 2012, as financial security remained critical for many in the wake of the crash.

Moreover, all major gender, age and income groups topped or tied the preference for real estate, coinciding with a number of recent initiatives set to increase opportunities for a diverse range of would-be buyers. These include the Fannie- and Freddie-backed three percent down payment program and the reassessment of credit strictures that have historically prevented borrowers from obtaining a mortgage.

Between July 2002 and April 2007, preferences for real estate fluctuated with the market, peaking at 50 percent during the boom and sinking to 37 percent as the economy nosedived. Preferences for real estate continued to fall through 2008 and 2009.

The Gallup poll was conducted April 9-12, 2015 from a random sample of 1,015 adults aged 18 and older living in all 50 U.S. states and the District of Columbia. For a complete look at responses, questions and trends, click here.

Mike Spruell

Realtor®/Broker/ePRO

The Lake Norman Homes Team

Southern Homes Elite

www.LakeNormanRealEstate.pro

866-LakeNorman

704-907-7907

Reprinted with permission from RISMedia. ©2015. All rights reserved.

read moreQ: Where Can You Find Fixer-Uppers?

- Mar

- 31

- Posted by Lake Norman Homes Realty

- Posted in Home Buyers Blog

- 0

A: They are literally everywhere, even in wealthy enclaves. What sets them apart is price. They have lower market value than other houses in the immediate area because they have either been poorly maintained or abandoned.

To determine if a property that interests you is a wise investment will require a lot of work. You will need to figure out what the average home in the area sells for, as well as the cost of the most desirable ones.

Experts suggest that novices avoid run-down properties needing extensive work. Instead, they recommend starting with a property that only needs minor cosmetic work – one that can be completely refurbished with paint, wallpaper, new floor and window coverings, landscaping, and new appliances.

Also, keep in mind that a home price that looks too good to be true probably is. Find out why before pouring your hard-earned money into it.

When looking for a fixer-upper, some experts suggest you follow this basis strategy: find the least desirable home in the most desirable neighborhood. Then decide if the expense that is needed to repair the property is within your budget.

Mike Spruell

Realtor®/Broker/ePRO

The Lake Norman Homes Team

Southern Homes Elite

www.LakeNormanRealEstate.pro

866-LakeNorman

704-907-7907

Reprinted with permission from RISMedia. ©2015. All rights reserved.

read more5 Tips to Take the Stress Out of Searching for a Home

- Feb

- 24

- Posted by Lake Norman Homes Realty

- Posted in Home Buyers Blog

- 0

By Keith Loria

As the spring home-buying season approaches, now’s the time to make sure you have everything in order so that you can hit the ground running once the warm weather arrives. To ensure the process is as simple and painless as possible, take the following advice to heart as you search for your new home.

1. Be Willing to Walk Away. You may have found the home of your dreams, but that doesn’t mean you should pay way over asking price or make concessions that you don’t want to make. If the negotiations begin to head in a direction you’re not comfortable with, take a step back and really consider the deal. Always keep an open mind and remember that there are other homes out there—some that might even fit your needs better. Plus, when a buyer walks away from a deal, more often than not, the seller’s agent is more inclined to reach back out and be more willing to work with you.

2. Set Reasonable Expectations. Everyone has an image of the perfect house in their mind, but depending on budget, location and many other factors, finding a home with everything you’re looking for may be impossible. Therefore, it’s always a good idea to make a list of the things you desire in a new home and arrange them from most important to least.

3. Look at Homes You Can Afford. This may seem like a no-brainer, but prospective buyers often house hunt and bid on properties that are way out of their price range. While it’s okay to look at a wide range of homes, including some that may be just above your price range, don’t waste your time looking at homes that are priced anywhere from 25 – 50 percent over what you can afford.

4. Know Your Budget. Before you get too invested in the home search process, figure out exactly what you can afford by making a list of all your expenses, including taxes and insurance. It’s also a good idea to get pre-approved on a loan before you even begin looking at homes. A pre-approval will not only be instrumental in determining the amount you’ll be loaned, it may also help you get a leg up on any competition for the home if there’s a bidding war.

5. Understand Your Financing Options. There are many different types of mortgages available for those looking to buy a home, including several special loans one may qualify for. With so many financing options out there, it’s crucial that you do your homework to ensure you’re getting the best rate. The last thing you want to do is jump at the first offer from a mortgage lender.

Contact our office today for more home-buying tips.

Mike Spruell

Realtor®/Broker/ePRO

The Lake Norman Homes Team

Southern Homes Elite

www.LakeNormanRealEstate.pro

866-LakeNorman

704-907-7907

Reprinted with permission from RISMedia. ©2015. All rights reserved.

read moreFederal Housing Administration Cut Mortgage Insurance Premiums

- Jan

- 29

- Posted by Lake Norman Homes Realty

- Posted in Home Buyers Blog

- 0

The number of first-time home buyers entering the housing market is at a 27-year low, according to the National Association of REALTORS®, but the Federal Housing Administration (FHA) took big steps this week to rectify that. Just last week, the FHA announced a 50 basis points reduction in mortgage premiums that, according to President Obama, will serve two important purposes: enticing new home buyers and encouraging existing borrowers to refinance at lower rates.

NAMB, The Association of Mortgage Professionals, led by CEO Don Frommeyer, has been pushing its Washington counterparts to make lower premiums a priority. “This is a great first step in helping to make homeownership more affordable for folks on Main Street,” says Frommeyer. “But there’s still plenty of work to be done.”

FHA borrowers will realize as much as $900 in savings annually on a $200,000 mortgage, which arguably will be filtered back into the economy to encourage ongoing recovery.

Frommeyer and the NAMB membership think this move makes sense from an industry perspective. Now, borrowers with better credit will consider FHA loans as opposed to mortgages financed solely through Fannie Mae or Freddie Mac.

“We support anything that makes homeownership more accessible and more affordable for millennials and first-time homebuyers,” says Frommeyer. “The market simply is not going to recover at the speed it should unless we continue taking steps to recruit this demographic. This is excellent news for the industry.”

For more information, visit www.namb.org.

Mike Spruell

Realtor®/Broker/ePRO

The Lake Norman Homes Team

Southern Homes Elite

www.LakeNormanRealEstate.pro

866-LakeNorman

704-907-7907

Reprinted with permission from RISMedia. ©2015. All rights reserved.

read moreCategories

- Boat Slip Communities

- Catawba Foreclosures

- Condo Foreclosures

- Cornelius Foreclosures

- Cornelius Real Estate

- Denver Foreclosures

- Denver Real Estate

- Featured Foreclosures

- Featured Listings

- Financing

- Foreclosure Market

- Gated Communities

- Golf Communities

- Home Buyers Blog

- Home Sellers Blog

- Huntersville Foreclosures

- Lake Access Communities

- Lake Norman Foreclosures

- Lake Norman Real Estate

- Market Updates

- Mooresville Foreclosures

- Mooresville Real Estate

- Sherrills Ford Foreclosures

- Statesville Foreclosures

- Swimming Pool Communities

- Tennis Court Communities

- Troutman Foreclosures

- Uncategorized

- Waterfront Condos

- Waterfront Foreclosures

- Waterfront Homes

- Waterfront Market

- Waterlynn Townhomes

Recent Posts

- Lake Norman Waterfront Condos

- Lake Norman Waterfront Homes For Sale

- March Home Prices Continue to Rise

- Americans Agree: Real Estate Best Long-Term Investment

- Q: Where Can You Find Fixer-Uppers?

Recent Comments

- Fixed Mortgage Rates Near Seven-Month Low | Lak... on Fixed Mortgage Rates Near Seven-Month Low

- luxuryhomechicago.com on Lake Norman Foreclosure Real Estate Market Update December 2011

- garrettrealestateservices.com on Lake Norman Foreclosure Real Estate Market Update December 2011

- hot props foreclosures on Lake Norman Real Estate Market Update August 2011

- Lake Norman Waterfront Real Estate Market Update January 2012 | Lake Norman Houses For Sale on Lake Norman Waterfront Condos For Sale