Americans Agree: Real Estate Best Long-Term Investment

- Apr

- 28

- Posted by Lake Norman Homes Realty

- Posted in Home Buyers Blog

- 0

By Suzanne De Vita

Signaling growing confidence in the housing recovery, a majority of Americans once again named real estate the best long-term investment – a trend now continued for two consecutive years, according to a recently released Gallup poll.

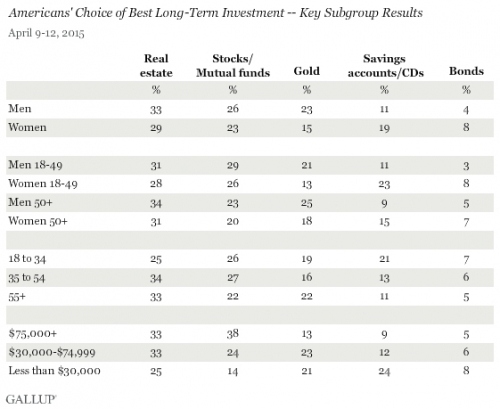

Real estate edged out long-term investment options like stocks/mutual funds, gold, savings accounts/CDs and bonds, with 31 percent of Americans favoring housing for long-term gains. Twenty-five percent of Americans named stocks/mutual funds as the best investment long-term. Gold dropped from frontrunner in 2011 and 2012 to third, while savings accounts/CDs fell to 15 percent. Bonds dipped to just six percent.

The findings represent a significant change in consumer sentiment akin to the ongoing recovery. Notably, more Americans preferred savings accounts/CDs in 2012, as financial security remained critical for many in the wake of the crash.

Moreover, all major gender, age and income groups topped or tied the preference for real estate, coinciding with a number of recent initiatives set to increase opportunities for a diverse range of would-be buyers. These include the Fannie- and Freddie-backed three percent down payment program and the reassessment of credit strictures that have historically prevented borrowers from obtaining a mortgage.

Between July 2002 and April 2007, preferences for real estate fluctuated with the market, peaking at 50 percent during the boom and sinking to 37 percent as the economy nosedived. Preferences for real estate continued to fall through 2008 and 2009.

The Gallup poll was conducted April 9-12, 2015 from a random sample of 1,015 adults aged 18 and older living in all 50 U.S. states and the District of Columbia. For a complete look at responses, questions and trends, click here.

Mike Spruell

Realtor®/Broker/ePRO

The Lake Norman Homes Team

Southern Homes Elite

www.LakeNormanRealEstate.pro

866-LakeNorman

704-907-7907

Reprinted with permission from RISMedia. ©2015. All rights reserved.

Categories

- Boat Slip Communities

- Catawba Foreclosures

- Condo Foreclosures

- Cornelius Foreclosures

- Cornelius Real Estate

- Denver Foreclosures

- Denver Real Estate

- Featured Foreclosures

- Featured Listings

- Financing

- Foreclosure Market

- Gated Communities

- Golf Communities

- Home Buyers Blog

- Home Sellers Blog

- Huntersville Foreclosures

- Lake Access Communities

- Lake Norman Foreclosures

- Lake Norman Real Estate

- Market Updates

- Mooresville Foreclosures

- Mooresville Real Estate

- Sherrills Ford Foreclosures

- Statesville Foreclosures

- Swimming Pool Communities

- Tennis Court Communities

- Troutman Foreclosures

- Uncategorized

- Waterfront Condos

- Waterfront Foreclosures

- Waterfront Homes

- Waterfront Market

- Waterlynn Townhomes

Recent Posts

- Lake Norman Waterfront Condos

- Lake Norman Waterfront Homes For Sale

- March Home Prices Continue to Rise

- Americans Agree: Real Estate Best Long-Term Investment

- Q: Where Can You Find Fixer-Uppers?

Recent Comments

- Fixed Mortgage Rates Near Seven-Month Low | Lak... on Fixed Mortgage Rates Near Seven-Month Low

- luxuryhomechicago.com on Lake Norman Foreclosure Real Estate Market Update December 2011

- garrettrealestateservices.com on Lake Norman Foreclosure Real Estate Market Update December 2011

- hot props foreclosures on Lake Norman Real Estate Market Update August 2011

- Lake Norman Waterfront Real Estate Market Update January 2012 | Lake Norman Houses For Sale on Lake Norman Waterfront Condos For Sale