Four Ways to Boost Your Credit Score

- Oct

- 31

- Posted by Lake Norman Homes Realty

- Posted in Home Buyers Blog

- 0

A recent Federal Trade Commission study showed that approximately 26 percent of consumers have credit report mistakes that could lead to higher loan and insurance payments. More than a quarter of participants in the study found at least one error on their credit reports, and five percent had errors serious enough to affect loan terms.

“Credit reports play a crucial role in determining consumers’ financial discipline and responsibility,” said Howard Dvorkin, CPA and Chairman of Debt.com. “Detecting credit report errors allows consumers to correct inaccurate information that could potentially lead to denied loans and high interest rates.”

Dvorkin advises that consumers review their credit report and take steps to correct any issues. He recommends:

Correcting errors on credit report – Consumers should check their credit score at least three months before making a purchase. If they identify mistakes, consumers should write a letter to the credit bureau and organization responsible for reporting the inaccurate information. In the letter they should explain why the information is incorrect and what should be changed on the credit report.

Asking for a credit-line increase – The credit utilization ratio is one of the major factors that contribute to the overall credit score. Using too much of the available credit can have a negative impact on a credit score. While it’s possible to fix this issue by paying down debt, sometimes consumers may not be able to afford it. To avoid having a low score, consumers should call their card provider and ask for a reduction of their interest rate. This could help consumers to pay off their balance quicker.

Consolidating your debt – Another quick way for consumers to improve their credit score is to consider consolidating their credit card debt. This can make it easier to pay down debt and also increase the average age of revolving credit lines, which can help the credit utilization ratio.

Consumers shouldn’t add an installment loan to their credit portfolio “just because,” but if they are in need of a student or personal loan, they may be able to quickly improve their credit score. Creditors want to see that consumers can handle a wide array of debt, so having this type of loan can be beneficial. If consumers are in dire need of improving their score, taking out a small personal loan that they can pay back over time could help.

Using an old card – If consumers have a card that they haven’t used in a while, they can start making purchases with it again. Not using a card for an extended period of time could lead to credit card providers no longer reporting it to the three major bureaus. By simply using an old card, consumers can increase their credit utilization ratio and extend their history.

Source: Debt.com

Mike Spruell

Realtor®/Broker/ePRO

The Lake Norman Homes Team

Southern Homes Elite

www.LakeNormanRealEstate.pro

866-LakeNorman

704-907-7907

Reprinted with permission from RISMedia. ©2014. All rights reserved.

read more7 Helpful Tips for First-time Homebuyers

- Oct

- 31

- Posted by Lake Norman Homes Realty

- Posted in Home Buyers Blog

- 0

By Bill Gassett

Looking for a new home can be a pretty exciting task. With that much money on the line, it’s worthwhile to read up on the process before you set out. Unnecessary mistakes can—and should—be avoided while trying to get the best deal for your money. As a first-time homebuyer, proper guidance from seasoned professionals can make all the difference.

Here are a few tips first-time buyers can use when trying to find their first home:

1. Get clear on what you want – This is the most important part of your preparation. You are about to enter a shopping experience that is unlike any other. At times, it can be stressful and difficult. There is a lot of money on the line and a big commitment to be made, so prepare accordingly. Get clear on what you really want and what you are willing to compromise on. This will make your home-shopping experience much more efficient and will give you a map to go off of should tensions run high. The better prepared you are, the better chance of having a smooth transaction.

2. Do your research – Home shoppers today are more empowered than ever before. You have so much information at your fingertips. Go online and find the areas you want to live in. Narrow down the neighborhoods you want to consider to three or four, and focus on those. Learn about the cost of the things you really want and the cost of the things you can do without. The more knowledgeable you are, the better you will be at negotiating a good deal.

3. Talk to the bank – Preparing to get a mortgage in advance of your actual purchase will be super important. Before you start looking at houses, have a discussion with your lender. The lender will be able to give you an honest assessment of what your finances look like, how much house you can afford and what your rates will be. You want to know all of this—what it will really cost you—before you start looking at homes you can’t actually afford. Find out what your monthly payment will be at different rates and determine what your personal limits are as well. Depending on your credit, the lender may be willing to give you far more than you need. Once you know the time is right to buy a home, make sure you get pre-approved by a lender. Make sure you understand the difference between getting pre-approved and pre-qualified for a mortgage. Without a doubt, you will want to get pre-approved, as a pre-qualification letter is not worth much. A savvy REALTOR® representing a homeowner will pick up on this right away. If you are competing with other buyers and are not financially prepared, you could lose out on your dream home.

4. Think about the future – Is this going to be a starter house that you will move out of in five years? Is it going to be a property that you fix up and flip? Is it going to be the home for your new family that you will be in for 10 or 20 years? Your long-term plans will help dictate your purchasing choices. It is important to understand what you really want this home for before you go and sign any papers and spend any money. One of the biggest mistakes first-time homebuyers make is not thinking about their long-term plans.

5. Find a good REALTOR® – A real estate agent can prove invaluable when shopping for a home. If you find one that is good—an agent that is finding people the homes they want at a price they are happy with—then much of the work will be done for you. The agent will talk about what you want, will run you through much of the above mentioned areas and will help you find the houses that are really what you are looking for. The agent will also be an effective negotiator, meaning that you will probably get more house for your money than if you went at it alone.

6. Set a timeline – The situation you are in is uniquely your own. You want to set a timeline for when you will find and buy home—a timeline that reflects your realities. If you have bad credit that needs to be cleaned up first, for instance, you will need to spend some time working on that before you actually start house hunting. If you need to move right now, that is another factor in your timeline. Give yourself some restrictions so you will be encouraged to move at a steady pace and get the job done. Hunting for a house can be quite stressful and it is not something that should be drawn out any more than necessary. Determine what you want, work with a REALTOR®, and get it

as efficiently as possible.

7. Understand your fiscal responsibility – Another problem that first-time homebuyers don’t always properly think through is the financial responsibility of owning a home. A large amount of buyers will think about making their mortgage payments and nothing else. If you have been renting for a while, or even living with mom and dad, it is easy to see why this can happen. Unfortunately, owning a home comes with quite a few more first-time home expenses that you may not have considered, such as appliances, furniture, and even taxes and insurance. These are all important things to consider when putting together your home buying budget.

Use all of the above tips for finding your first home and you will be well on your way to enjoying your new life as a homeowner.

Bill Gassett is a nationally recognized real estate leader who has been helping people move in and out of the Metrowest Massachusetts area for the past 27-plus years. He has been one of the top RE/MAX REALTORS® in New England for the past decade. In 2013, he was the No. 1 RE/MAX agent in Massachusetts.

This article originally appeared on RISMedia’s blog, Housecall.

Mike Spruell

Realtor®/Broker/ePRO

The Lake Norman Homes Team

Southern Homes Elite

www.LakeNormanRealEstate.pro

866-LakeNorman

704-907-7907

Reprinted with permission from RISMedia. ©2014. All rights reserved.

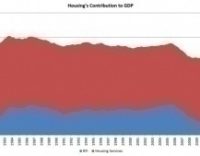

read moreHousing’s Share of GDP: 15.5 Percent for the Second Quarter

- Sep

- 30

- Posted by Lake Norman Homes Realty

- Posted in Home Buyers Blog

- 0

By Robert Dietz

Housing is an important source of economic growth. As of the second quarter of 2014, housing’s share of gross domestic product (GDP) was 15.5 percent, with home building and remodeling yielding 3.1 percentage points of that total.

.jpg)

Housing-related activities contribute to GDP in two basic ways.

The first is through residential fixed investment (RFI). RFI is effectively the measure of the home building and remodeling contribution to GDP. It includes construction of new single-family and multifamily structures, residential remodeling, production of manufactured homes and brokers’ fees. For the second quarter, RFI was 3.1 percent of the economy.

The RFI component reached a $496 annualized pace during the second quarter. This is the second highest quarterly total for RFI since the middle of 2008. Overall GDP expanded by 4.6 percent for the quarter, with RFI adding 0.27 points of that total.

The second impact of housing on GDP is the measure of housing services, which includes gross rents (including utilities) paid by renters, and owners’ imputed rent (an estimate of how much it would cost to rent owner-occupied units) and utility payments. The inclusion of owners’ imputed rent is necessary from a national income accounting approach because without this measure increases in homeownership would result in declines for GDP. For the second quarter, housing services was 12.4 percent of the economy.

Historically, RFI has averaged roughly 5 percent of GDP while housing services have averaged between 12 percent and 13 percent, for a combined 17 percent to 18 percent of GDP. These shares tend to vary over the business cycle.

View this original post on the NAHB blog, Eye On Housing.

Mike Spruell

Realtor®/Broker/ePRO

The Lake Norman Homes Team

Southern Homes Elite

www.LakeNormanRealEstate.pro

866-LakeNorman

704-907-7907

Reprinted with permission from RISMedia. ©2014. All rights reserved.

read moreQ: What Should I Do to Prepare My Home for Sale?

- Sep

- 30

- Posted by Lake Norman Homes Realty

- Posted in Home Sellers Blog

- 0

A: Start by finding out its worth. Contact a real estate agent for a comparative market analysis, an informal estimate of value based on the recent selling price of similar neighborhood properties. Or get a certified appraiser to provide an appraisal.

Next, get busy working on the home’s appearance. You want to make sure it is in the best condition possible for showing to prospective buyers so that you can get top dollar. This means fixing or sprucing up any trouble spots that could deter a buyer, such as squeaky doors, a leaky roof, dirty carpet and walls, and broken windows.

The “curb appeal” of your home is extremely important. In fact, it is the first impression that buyers form of your property as they drive or walk up. So make sure the lawn is pristine – the grass cut, debris removed, garden beds free of weeds, and hedges trimmed.

The trick is not to overspend on pre-sale repairs and fix-ups, especially if there are few homes on the market but many buyers competing for them. On the other hand, making such repairs may be the only way to sell your home in a down market.

Mike Spruell

Realtor®/Broker/ePRO

The Lake Norman Homes Team

Southern Homes Elite

www.LakeNormanRealEstate.pro

866-LakeNorman

704-907-7907

Reprinted with permission from RISMedia. ©2014. All rights reserved.

read moreU.S. Waterfront Home Values Twice as High as Overall Home Values

- Sep

- 22

- Posted by Lake Norman Homes Realty

- Posted in Home Buyers Blog

- 0

Nationwide, the typical oceanfront or lakefront, single-family home is worth more than double the median value of all homes, and in some communities the median waterfront house could be worth ten or more times the median value of non-waterfront houses, according to a new analysis by Zillow®. In the U.S. at the time of this analysis, the median single-family home was worth about $171,600, while the median waterfront house was valued at $370,900, a waterfront premium of 116.1 percent.

Among large cities analyzed, the biggest difference between median non-waterfront single-family home values and median waterfront house values are in Tampa, Fla. (waterfront premium of 733 percent); Honolulu, Hawaii (waterfront premium of 334.5 percent) and Long Beach, Calif. (waterfront premium of 321.6 percent).

“The allure of ocean and lakefront living is powerful and undeniable, and millions of homeowners nationwide dream of one day owning a home on the water. But those dreams come at a price,” says Zillow Chief Economist Dr. Stan Humphries. “Waterfront properties are both relatively scarce and highly coveted, and that high demand and limited supply leads to higher home prices. Additionally, added insurance, floods, environmental mitigation and infrastructure costs are often part of the tab when buying a waterfront home. Still, as long as buyers understand the added costs and potential headaches, waterfront living is likely to remain one of life’s simple pleasures for many, many years to come.”

The median waterfront home value is calculated in the same way as the Zillow Home Value Index, and represents the median value of all single-family waterfront homes in a given community. The index includes single-family homes located 150 feet or closer to the waterline of an ocean or lakes with a total combined size of 10 square kilometers or greater. Properties separated from direct waterfront by a road with a speed limit of 25mph or less are also considered waterfront. Riverfront properties were not included in this analysis, nor were condominium or co-op housing units. Zillow’s initial analysis covers 250 cities and towns nationwide with at least 100 waterfront homes meeting the above criteria.

Information on all 250 cities analyzed can be found on Zillow Research here.

Mike Spruell

Realtor®/Broker/ePRO

The Lake Norman Homes Team

Southern Homes Elite

www.LakeNormanRealEstate.pro

866-LakeNorman

704-907-7907

Reprinted with permission from RISMedia. ©2014. All rights reserved.

read moreCategories

- Boat Slip Communities

- Catawba Foreclosures

- Condo Foreclosures

- Cornelius Foreclosures

- Cornelius Real Estate

- Denver Foreclosures

- Denver Real Estate

- Featured Foreclosures

- Featured Listings

- Financing

- Foreclosure Market

- Gated Communities

- Golf Communities

- Home Buyers Blog

- Home Sellers Blog

- Huntersville Foreclosures

- Lake Access Communities

- Lake Norman Foreclosures

- Lake Norman Real Estate

- Market Updates

- Mooresville Foreclosures

- Mooresville Real Estate

- Sherrills Ford Foreclosures

- Statesville Foreclosures

- Swimming Pool Communities

- Tennis Court Communities

- Troutman Foreclosures

- Uncategorized

- Waterfront Condos

- Waterfront Foreclosures

- Waterfront Homes

- Waterfront Market

- Waterlynn Townhomes

Recent Posts

- Lake Norman Waterfront Condos

- Lake Norman Waterfront Homes For Sale

- March Home Prices Continue to Rise

- Americans Agree: Real Estate Best Long-Term Investment

- Q: Where Can You Find Fixer-Uppers?

Recent Comments

- Fixed Mortgage Rates Near Seven-Month Low | Lak... on Fixed Mortgage Rates Near Seven-Month Low

- luxuryhomechicago.com on Lake Norman Foreclosure Real Estate Market Update December 2011

- garrettrealestateservices.com on Lake Norman Foreclosure Real Estate Market Update December 2011

- hot props foreclosures on Lake Norman Real Estate Market Update August 2011

- Lake Norman Waterfront Real Estate Market Update January 2012 | Lake Norman Houses For Sale on Lake Norman Waterfront Condos For Sale